The COVID-19 pandemic triggered a violent sell-off of stocks.

But a robust rebound followed, creating a new generation of investors seeking

a solution to their precarious income and savings situations.

Im Su-bin, a 29-year-old college senior, recently started investing in stocks with 300,000 won (approximately US$260) that she had earned by working part-time. Although finding internships is not particularly difficult in Korea, it can seem impossible to land a decent full-time job becausecompanies are hesitant about adding permanent employees. Out of desperation, Im moved toward stock trading to help cover expenses.Kim A-ram, a 33-year-old freelance translator, planned to spend some of her savings on her honeymoon last December. But regulations to stem COVID infections meant that many relatives and friends wouldn’t be able to attend her wedding. And so she postponed it and put her honeymoon stash in the stock market. She is pinning her hopes on a bullish market that will yield whatever money possible to help start off her married life.These two novice investors aren’t rarities in their age group. In 2020, there were 9.14 million individual investors in the Korean stock market, and about one-third of them were newcomers, according to the Korea Securities Depository.

A slew of online apps facilitates stock transactions. Brokerages offer incentives to capture a rapid increase in new investors in their 20s and 30s, many of them so-called “ants” who hope to turn modest salaries into fat gains. © freepik

Novice Investors

The total amount of stocks owned by individual investors was valued at 662 trillion won as of late2020, up 243 trillion won from 419 trillion won in late 2019. Individual investors accounted for 28 percent of the total market value, up 3.6 percentagepoints on-year.

Men owned 489 trillion won worth of stocks, more than double the amount owned by women,but women evidently excelled in picking stocks; the value of stocks owned by female investors increaseda whopping 77 percent, from 97 trillion won in 2019 to 173 trillion won in 2020. Meanwhile, stocksbelonging to male investors rose 52 percent, from 321 trillion won to 489 trillion won, during the same period.

Young adults in Korea have been struggling to secure stable, regular jobs for decades. Ever sincethe 1997 Asian financial crisis and the 2008 global financial meltdown, companies have reined in fulltime positions, relying instead on a parade of shortterm hires. Simultaneously, prolonged low interest rates have made savings accounts nonviable. This has left many young adults struggling financially, to say nothing of saving for marriage or purchasing a home.

Young adults in Korea have been struggling to secure stable, regular jobs for decades. Ever sincethe 1997 Asian financial crisis and the 2008 global financial meltdown, companies have reined in fulltime positions, relying instead on a parade of shortterm hires. Simultaneously, prolonged low interest rates have made savings accounts nonviable. This has left many young adults struggling financially, to say nothing of saving for marriage or purchasing a home.

Then COVID-19 opened up a window of opportunity. On January 5, 2020, the benchmark KoreaComposite Stock Price Index (KOSPI) closed at 2206. But as the pandemic’s existential threat tothe economy became more alarming, the KOSPI swooned until finally bottoming out at 1566, a 29percent loss, on March 20. From there, it rebounded as Korea harnessed its COVID caseload, and optimism over vaccine development, government stimulus and economic recovery fueled a sharp rally.

Stock prices had been at bargain levels and it was clear that their steady rise back to normal meantfast profits were attainable. Waves of young people opened accounts to “row their own boats when the water comes,” as the Korean saying goes. Then, as the year unfolded, the labor market gave them even more reason to seek fast cash. According to Statistics Korea, 3.51 million people in their 20s had jobs as of December 2020, down 3.9 percentage points from a year earlier, and falling more drastically than in other age groups. Proportionately, the unemployment rate rose, with the rate among 20-somethings increasing by 0.9 percentage points on-year inDecember 2020.

Buying Frenzy

Individuals, especially fledgling investors in their 20s and 30s, reportedly accounted for most of the increase in stock trading during 2020 – and their opportunistic frenzy paid off handsomely. The KOSPI closed out 2020 at 2873.47, more than 80 percent above the year’s low in March.

New buzzwords and phrases have accompanied the groundswell. One of these is “Donghak Ant Movement,” derived from the peasant followers ofDonghak, or “Eastern Learning,” who rebelled against foreign intrusion toward the end of the 19th century during the Joseon era. The term implies that young, small-scale investors are buying stocks to protect the domestic stock market from foreign institutional investors. “Ants” refer to young, salaried workers.Another buzzword is jurini, coined from jusik (stock) and eorini (child), meaning “beginner stock investors.”

Media coverage has also expanded. In the past, only TV channels dedicated to business dealt withstocks and investing. But today, even entertainment shows cover these topics. A typical example is “March of the Ants,” a KakaoTV variety show hostedby celebrities. Launched last September, the program showcases how the celebrities invest in stocks usingaccounts opened in their names. It received favorable audience responses and has been available on Netflix. Each episode averages two million views.Meanwhile, MBC TV introduced a talk show focused on stock trading, “Ant’s Dream,” as a twopart pilot. Economic experts gave celebrities detailedexplanations on the basics of stock trading. And on SBS TV, a special episode of its long-running variety show “Running Man” presented a mock stock market scenario. Popular TV host Yoo Jae-suk also spoke with three young stock investors as part of the show “Hangout with Yoo” on SBS in March.

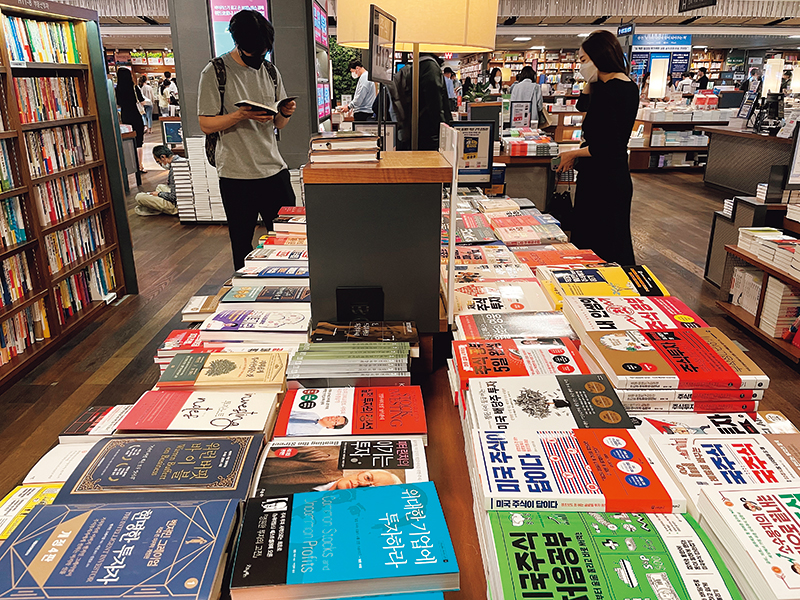

Sales volume and revenue from books on stocks,investing and mutual funds were five times higher inthe first quarter of 2021 compared to the sameperiod in 2020, according to Interpark, an online book platform.

Lasting Trend

Experts believe that young adults’ enthusiasm for stock trading has long-term sustainability. Fordecades, there has been no meaningful relief from fragile employment and soaring home prices. Despite a series of government countermeasures, apartmentprices in Seoul, where nearly half the population of Korea resides, have doubled over the past few years.With their dreams of owning a house evaporated, young people naturally delay marriage. In 2020, the number of marriages plunged to an all-time lowsince records began in 1970. Some 214,000 couples tied the knot last year, down 10.7 percent on-year,according to Statistics Korea.

“March of the Ants,” a KakaoTV variety show thatgives stock investment tips to beginner investors, has been renewed for a fourth season.

A survey by online job portal service JobKorea found three out of every 10 university students in the country areinvesting in stocks. About a half of them jumped into the stock market less than a year ago as the COVID pandemicworsened their already weak employment prospects.

“The current 20- and 30-somethings are completely different from previous generations, who bought cars and dreamed of buying homes by savingtheir monthly salary,” said Park Sung-hee, a senior fellow at the Korea Trend Research Institute. “These days, young people rent cars, and buying homes is aremote possibility for them.”

“Rather than saving for the distant future, they are looking for a chance to gain profits from shortterm investments made with small amounts of money,” she said. “Jobs are hard to find and none guarantee life-long employment. This trend has become even more conspicuous since the outbreak of the coronavirus pandemic.”

“Young people seek investment targets that don’t require in-person contact. In a situation where it’s almost impossible to travel abroad freely, they naturally turned their eyes to stock trading, which they can easily do using a smartphone,” Park added.