The Korean Wave sparked by TV dramas has recently expanded to beauty products, giving rise to “K-beauty.” With the explosive popularity of Korean skincare and makeup products among overseas consumers and their rising influence in the global market, the Korean cosmetics industry has reached a significant turning point.

Numerous “road shops” and flagship stores of Korean beauty brands line the streets of Myeong-dong in downtown Seoul, the most popular shopping destination among tourists.

The Korean Wave, which was fueled by the popularity of Korean TV dramas in China, Japan and Southeast Asia in the 2000s, has since expanded to the rest of the world. K-pop has also become a powerful driver of hallyu, and more recently, K-beauty has taken the global beauty world by storm.

This past May, global cosmetics giant L’Oréal acquired Korean fashion company Stylenanda’s mid-low priced makeup brand 3CE for 400 billion won (US$351 million) with the aim of expanding to China, where 3CE ranks number one in color cosmetics brand recognition. And last year, Unilever, a British-Dutch transnational consumer goods company, paid 3 trillion won (US$2.7 billion) for Carver Korea, a homegrown cosmetics firm known for its skincare brand AHC.

In 2014, the New York Times article “South Korea Exports Its Glow” said that Korean skincare products had taken over the American beauty market, traditionally dominated by European and Japanese brands.

K-beauty took off in earnest around 2014 when BB cream became a sensation. Korean beauty companies developed the cream, originally d for use after dermatological procedures, into an all-in-one product for everyday use, merging foundation, moisturizer and sunscreen. Buoyed by its popularity, cosmetics topped the list of Korea’s online exports, signaling strong growth in the industry.

Up until then, in Europe and America, Asian beauty had been synonymous with Japanese beauty. Japanese cosmetics brands with a long history, such as Shiseido, Kanebo and Kosé, had secured early dominance in those markets with their presence in major department stores in New York, Paris, London and Milan. Another Japanese brand, SK-II, was enjoying huge popularity worldwide on the back of aggressive marketing by its parent company, Procter & Gamble, an American competitor of Unilever.

On the other hand, not a single Korean cosmetics brand had entered a high-end department store overseas, or if they had they did not last long.

That’s when BB cream hit the scene, paving the way for the globalization of K-beauty. The BB cream craze was widely covered by American Vogue and beauty magazine Allure, as well as many other magazines. Pointing out that the versatile cream originated in Korea, they raved about its multitasking properties: evening skin tone and producing a natural, no-makeup look in addition to providing sun protection. The K-beauty craze continued with CC cream, followed by sheet masks. Sheet masks actually emerged as the new icon of K-beauty, spawning rumors that “Korean women use a sheet mask once a day.”

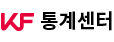

The global success of Korean beauty products has led to structural changes in the domestic industry. According to the Ministry of Food and Drug Safety, the number of cosmetics manufacturers and distributers soared from 3,884 in 2013 to 8,175 in 2016 and further to 10,080 in 2017. The Korea Customs Service reported that in 2017, cosmetics exports had jumped 18.5 percent year-on-year to a record high of US$4,968 million (5,291 billion won), and expected the growth momentum to continue this year. This is phenomenal growth, especially considering lagging sales in the Chinese market amid political tensions over the deployment of the advanced anti-missile system THAAD in South Korea.

Behind such a strong showing are efforts to continually pursue innovative ideas in product development, such as convergence technology, which has been a recent trend. “Cosmeceuticals,” combining cosmetics and pharmaceuticals, are emerging as a new driver of growth. Beauty products that go a step beyond skin-brightening and anti-aging are set to become the next big thing.

Hallyu stars have been the driving force behind the K-beauty craze. In 2014, the lipstick and face powder that actress Jun Ji-hyun (a.k.a. Gianna Jun) wore in the hit TV series “My Love from the Star” became all the rage and exports surged. In 2016, the products endorsed by Song Hye-kyo enjoyed continuing popularity overseas after the broadcast of her hit mini-series “Descendants of the Sun.” Copying the look of K-pop girl groups like Twice and Mamamoo has become a fad among women in many countries.

But it would not be fair to give all the credit to celebrities. Beauty industry workers have contributed just as much to the stunning growth. Industry experts say that the greatest strength of Korean cosmetics companies lies in their ability to swiftly execute ideas and incorporate technology. The diversity of ingredients is also an important factor behind the global success. Korean cosmetics brands are quick to launch products infused with novel, even wacky, ingredients. Among notable examples are mask packs containing donkey milk, which is said to be similar to human breast milk in its composition, skincare products formulated with herbal ingredients and moisturizing creams infused with snail mucin.

Overseas cosmetics merchandisers also point out that excellent quality is the underlying strength of K-beauty. This can be attributed in part to domestic consumers who seek good quality for an affordable price. Their high standards have prompted cosmetics companies to continually strive for higher quality.

Beauty industry experts say that the greatest strength of

Korean cosmetics companies lies in their ability to swiftly execute ideas

and incorporate technology.

YouTube beauty creators have also played an instrumental role in propagating K-beauty. Their influence has been growing in line with the shift in marketing strategies of domestic cosmetics companies. Rather than making expensive television commercials, cosmetics brands are more willing to collaborate with beauty vloggers with greater impact online. Popular beauty YouTubers with an eye on the global market are creating content tailored for overseas viewers with subtitles in various languages, including English, Chinese and Thai.

Top beauty creators enjoy celebrity status. Star YouTubers, such as Risabae, Ssin and Pony, have enormous commercial clout, often selling 100 million won worth of products just five minutes into their shows. They have appeared in commercials for major cosmetics brands, such as AmorePacific and LG Household & Health Care, and collaborated on marketing campaigns. Influenced by popular Korean beauty creators, a growing number of foreign YouTubers and beauty bloggers have also started to produce Korean makeup tutorials. One-person media creators are emerging as powerful figures behind K-beauty.

It will be interesting to watch their contributions going forward. Naver, Korea’s leading web portal, also provides beauty content through its blog and video platforms. Currently, some 7,000 content creators and 900 professional beauty creators, including former Miss Korea turned beauty influencer Lee Sarah, are active on Naver.

As beauty content creators continue to expand their sphere of influence, many young people dream of entering the field. Whereas in the past, beauty-related jobs usually meant makeup artist, beautician or nail artist, many youth today pursue a career as a beauty creator. Catering to this trend, several universities have opened related departments, and beauty schools and web portals are providing diverse educational programs.

As word spreads among overseas consumers via YouTube and social media that Korean beauty products are worth the extra cost and time for international delivery, the efforts of domestic cosmetics brands to enter overseas markets are gaining momentum.

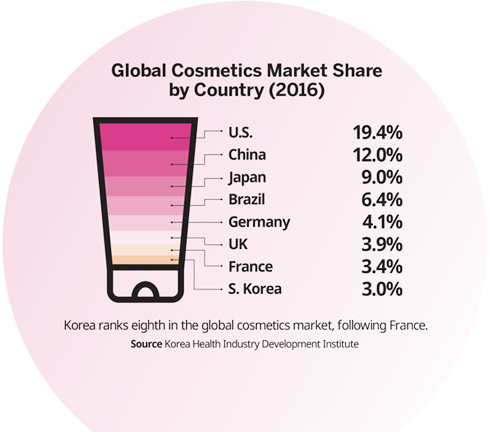

K-beauty is all the rage in Japan, the third largest cosmetics market in the world after America and China. According to the Korea Customs Service, direct online sales of Korean beauty products to Japan reached 47.8 billion won in the first quarter of 2018, representing an 850 percent year-on-year increase. In China, too, despite the sharp decline in Chinese tourists visiting Korea in the wake of the THAAD dispute, Korean beauty products are still hot. According to annual consumption data by Tmall Global, China’s biggest e-commerce site where foreign brands can sell directly to Chinese consumers, Korean products ranked fifth in sales among all imports in 2017. There was particularly strong demand for Korean mask packs, which accounted for around half of last year’s total mask pack sales of 700 billion won.

The next big market is Vietnam, which has emerged as the “post-China” market. With 70 percent of the population being under 40 years old, Vietnam represents a lucrative cosmetics market, which was worth some 250 billion won in 2017. Hence, beauty brands from not only Korea, but also Japan, America and Europe are vying for a greater share of the market. Among them, Korean brands are the dominant ps, commanding a 50 percent market share.

Going beyond Asia, the K-beauty craze has reached the Western world as well. During the first half of 2017, Korea’s cosmetics exports to the United States reached US$270 million, an increase of 43.3 percent over the previous year. As global retailers have become more receptive of Korean brands, it is no longer hard to find Korean beauty products at department stores and outlet malls across the United States.

According to 2016 statistics by the Korea Cosmetic Industry Institute, over 70 percent of Korean cosmetics’ overseas markets were concentrated in Asia, with China accounting for 39.1 percent, Hong Kong 24.7 percent, Japan 4.6 percent and Taiwan 3.1 percent. The United States accounted for 9.1 percent, the highest outside Asia. Recently, however, domestic brands are witnessing visible changes in the European market. In particular, natural beauty products made from plant-based ingredients, such as ginseng, green tea and aloe, have appealed to vegan consumers. K-beauty is further expanding its reach into the Latin American market, too, fueled by the soaring popularity of BTS and other pop stars.

Not only has the Korean beauty market grown quantitatively, it has also been showing strong qualitative growth. Many global cosmetics brands are using the Korean market as a test bed, carefully gauging consumers’ reactions to their products. Driven by continuing efforts for product innovation and discovery of new ingredients, as well as the training of beauty content creators and the global popularity of hallyu stars, K-beauty is expected to continue its strong growth path in the global cosmetics market, valued at around US$532 billion as of 2017.

Ssin

at the Vanguard of K-Beauty

In recent years, Halloween has become popular among young Koreans as a chance to dress up and explore their alter egos. Last year, Ssin d an ambitious series titled “13 Days of Halloween,” where she showcased a different spooky look for 13 consecutive days, ranging from a coy, silver-wigged cat with glittery eye shadow and face jewels to a ghoulish, black-and-white clown cloaked in black, for her 1.6 million subscribers.

The Halloween series perhaps best exemplifies what sets Ssin apart from many beauty gurus both near and far. She is considered second to none when it comes to sharing daily makeup tips, from choosing the best products of the season for a given local brand to taking passport photos that won’t embarrass you years down the road. But she is best known for transforming into improbable personas — such as male celebrities and iconic cartoon characters.

“I actually feel a lot more at ease pulling off men, monsters or such. In fact, I find it much more taxing to try to be pretty,” she said.

Ssin, whose real name is Park Su-hye, was an art student at university when she first began posting YouTube videos of her incredible self-transformations. Her fascination with makeup began more as a means of self- rather than a wish to beautify. “I started experimenting with makeup at home when I was in junior high. I painted my face to emulate characters in ‘Cats’ or ‘Ju-on: The Grudge’ [Japanese ghost horror franchise].”

Soon, a hobby turned into a fulltime job, with collaboration projects with local makeup brands such as Too Cool for School, TV appearances and jet setting around the world.

With the growing influence of K-pop, Ssin’s uncanny ability to morph into a boy band member has made her one of the most in-demand beauty stars at industry events overseas, such as KCON, a convention and showcase for K-pop content held annually in southern California. She explains that South Korean beauty influencers have now become an integral part of such events, particularly in Southeast Asia. “The concept of influencers has recently become a phenomenon in Southeast Asia, much like in Korea five years ago. K-beauty is always featured in related events there, so I’ve been pretty busy traveling overseas.”

She continues to be amazed by the far-reaching influence of K-beauty and its content. “French locals recognized me on the streets of Paris, which was really strange,” she said. “Nowadays, you can easily find Korean makeup products at Sephora. I think Korean road shop brands should really be credited for the popularity of K-beauty. After all, who doesn’t appreciate a cutely packaged product that works well and is super affordable?”

한국국제교류재단

한국국제교류재단